If the primary time-frame is damaged the account must be viewed as uncertain and handled as an asset beneath elevated risk. Last payment dates are the final date earlier than legal action against the holder of the account may be taken. Relying on the policy of the company and the native legislature, this period can be as much as 90 days after the date acknowledged for the holder of the account.

Company

Accounts receivable are measured as property, that means they instantly improve the accounting liquidity ratio of the corporate. This follows the current normal that each belongings and liabilities are calculated if referring to a single financial 12 months or are within the range of 1 12 months from the date of calculation. To hold your money move brisk and healthy, you’ll be able to adopt some savvy strategies. Firstly, consider making prompt funds more alluring by providing sweet discounts for early birds. A little 2% off for funds inside 72 hours can inspire lightning-fast financial institution transfers. Automating reminders with tools corresponding to Synder also can gently nudge clients with out you breaking a sweat.

If such balancing is impossible, the corporate will want to borrow against accounts receivable to fulfill the time constraints of the accounts payable. As accounts receivable could additionally be used as nominal property by the company and simply borrowed towards a recognized and nominal worth, they are a vital factor in terms of each solvency and liquidity of the company. With such an approach, it is sure that any dangerous projection won’t affect the general account and won’t influence the accounts payable. This is crucial for a good credit rating and thus the overall health of the corporate. All accounts receivable which may be given as collateral for the mortgage granted ought to be accounted for on the proper as liabilities. This will ease the overview of the bills and won’t place the account out of balance.

Accounts Receivable (ar) Finance – Definition And Uses updated 2025

- The accounts payable steadiness is the entire quantity of unpaid bills owed to third events.

- It’s entered as a bad debt expense and not included within the present assets account if an account isn’t collected.

- If an uncollectible account is reported as AR, current belongings will be overstated.

- Without proper AR monitoring, businesses threat operating out of money even while showing a revenue on paper.

Shopper information and information may be situational relying on the kind of the corporate however is at all times priceless for better concentrating on. Also, higher customer relations may make sure the information about potential doubtful accounts. Companies that are usually paid over a interval of months could have a larger amount of receivables in the 60-day class. Posting accounts receivable transactions is a routine task that ought to be performed each month.

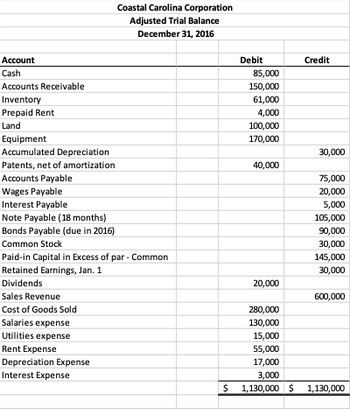

Software Program that automates your accounts receivable processes will assist hold your average DSO low and create a good expertise on your customers. Trial balances are established to trace and outline monetary activities for a given reporting interval. They are closed and their balances are lowered to zero at the finish of the reporting period. This is finished so as to prevent balances from being confused with the same activity for the following reporting interval or with everlasting accounts that retain continuous records.

It’s calculated utilizing methods like percentage-of-sales or getting older analysis, where historical data predicts potential losses. In right now’s competitive business landscape, mastering accounts receivable (AR) accounting is essential for corporations of all sizes. It not only safeguards liquidity but in addition enhances investor confidence and operational efficiency. This complete information delves into the necessities of AR accounting, offering sensible insights for business owners, financial managers, and entrepreneurs aiming to optimize their financial methods.

Accounts Receivable and Accounts Payable are like the ebb and circulate of your business’s monetary tide. While A/R represents the incoming wave of money that prospects owe you, A/P is the outbound present the enterprise owes to suppliers and distributors. They’re distinct in nature—one is an asset expected to bolster your bank account, while the other is a legal responsibility that represents your monetary obligations. Maintaining these functions separate helps preserve monetary integrity and reduces the risk of errors or, worse, fraudulent activities.

Each company has a cash circulate coming in and going out of its accounts, which permits accounts receivable common term and definition it to meet its payroll responsibilities, buy merchandise and supplies, and pay its payments and taxes. Accountants and financial operations managers must predict cash flow to appropriately foresee and plan to meet these obligations. Just like every sort of financial exercise, Accounts Receivables have to be recorded in the company’s accounting data. An Accounts Receivable transaction is recorded in a company’s financial reporting as an Accounts Receivable journal entry. Accounts Receivables embrace recorded transactions that the purchasers have yet to pay in full as they were made on credit. The dispute decision process is the procedure a enterprise goes by way of to research and resolve any disagreements between the business and the shopper concerning compensation.

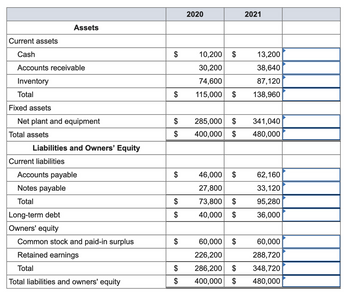

Accounts Receivable Examples In Monetary Statements

The example above makes use of 30-day increments to separate the money owed, however should you follow an atypical billing cycle or offer non-standard credit score choices, you may choose an alternate schedule. Further, we provided a much less complicated format that identifies a company’s accounts receivable on a single row. However, suppose your small business sends larger volumes of individual invoices to prospects over a month. In that case, you’ll likely choose a more detailed format with further rows that escape the owed quantities by specific bill. Your accounting software program should present an ageing schedule for accounts receivable, which teams your receivables based on when the bill was issued.

The purchaser has ninety days to pay for the goods that it ordered and acquired. Accounts receivable might sound like just another accounting term, but it’s the lifeblood of many businesses. From freelancers to massive companies, managing AR effectively can mean the difference between progress and financial struggles. If your business has $20,000 in accounts receivable, that money isn’t in your bank yet however it’s legally owed to you, so it’s handled as an asset. In this information, we’ll break down the accounts receivable meaning, why it issues, the means it works, and the best methods to manage it. Yes, accounts receivable could be sold or transferred in processes like factoring, the place a company sells its receivables at a reduction to a third party to improve liquidity.

You could have some uncomfortable conversations, but it’s better to have them ahead of later. If you’re diligent within the assortment https://www.personal-accounting.org/ course of, you can keep away from hiring a group company or an attorney to pursue collections on your behalf. All corporations ought to use the accrual foundation of accounting to create their financial statements. The Receivables Management Resolution that uses Artificial Intelligence to foretell cost issues and prioritize collection efforts in order to scale back your dangers and enhance your working capital.